Clifford Ray Moore Jr Inc

Tyler, Texas

Products Offered

Personal Insurance

Why Choose a Travelers Independent Insurance Agent?

An independent insurance agent serves as your advocate focused on protecting what’s important to you, and Travelers chooses to work with the most talented and trusted professionals in the business.

You can expect thoughtful attention from an experienced agent who will evaluate your unique circumstances, answer your questions, support you throughout your journey and recommend the right mix of coverages to help protect all the things that are important to you and your family. You get a trusted insurance advisor and champion for your needs when you choose a Travelers independent agent.

You can expect thoughtful attention from an experienced agent who will evaluate your unique circumstances, answer your questions, support you throughout your journey and recommend the right mix of coverages to help protect all the things that are important to you and your family. You get a trusted insurance advisor and champion for your needs when you choose a Travelers independent agent.

Featured Products

![Boat and yacht insurance]()

Boat & Yacht

Boat & YachtKnowing that you, your passengers and your vessel are protected can help you relax and enjoy your time on the water.

Frequently Asked Questions

Car insurance is designed to protect you and everyone who shares the road from the potentially high cost of accident-related and other damages or injuries. It is a contract in which you pay a certain amount — or “premium” — to your insurance company in exchange for a set of coverages you select. A basic car insurance policy is required for drivers in most states, although the mandatory minimum coverage and policy limits will vary. If you finance or lease your vehicle, your lender may also require specific car insurance coverages and limits. Beyond legal requirements, carrying car insurance is a smart decision. If you cause an accident or get into one with an uninsured or underinsured driver, you may be held responsible to cover related expenses, such as car repairs, property damage, medical bills, lost wages, legal fees and more. Without the proper coverage, your financial well-being may be at risk. Working with an insurance representative to create a car insurance policy that addresses your individual needs and budget can protect you, your loved ones and your assets in the aftermath of an accident.

You can save on your auto and home insurance when you bundle your policies with Travelers. And you can save even more with additional policies with our multi-policy discount.

Choosing an insurance policy that addresses your needs starts with choosing the right insurance company.Travelers has been an insurance leader, committed to keeping pace with the ever changing needs of our customers, for over 160 years. As one of the nation’s largest property and casualty companies, we offer a variety of competitive policy options and packages to help ensure you get the right coverage at the right price. An independent Insurance Agent can help you create a policy that addresses your needs and budget.We also give you peace of mind with a claim process that is simple and stress free. It is about making the process after any incident as simple and stress-free as possible. We’re here to support our customers and their families on the road to repair and recovery every step of the way — with fast, efficient claim services and insurance specialists available 24 hours a day, 365 days a year.

Ask your insurance representative about Travelers discounts for multiple policies.For auto insurance, where available, savings are commonly found in safe driver, multi-policy, multi-car, good student for those who qualify. Additional discounts may be available if you are insuring a new or hybrid/electric car, or own a home. How and when you pay can affect your premium, too — discounts may be available if you pay in full, by electronic funds transfer (EFT) or by payroll deduction, as well as if you pay on time. For your home, security systems or fire protective devices, certain smart home technologies, “green” home certification, loss-free history, and more can help you save on your insurance premiums. Discounts vary by state and eligibility.Remember to ask your insurance representative about these and other incentives to ensure you are getting all the discounts for which you are eligible.*Not all discounts are available in all states.

Homeowners insurance can protect you from the unexpected. If your home is damaged, your belongings are stolen or someone gets injured on your property, it can help cover repairs or replacement, temporary housing, medical bills, legal fees and more. A homeowners policy is recommended for anyone who owns a home or condo, and may even be required by your mortgage lender. In certain areas, you may need separate policies or coverage to help protect your home and personal belongings against damage due to floods, earthquakes, windstorms or hail.Most policies have 3 key elements: the premium which is how much you pay for coverage, deductibles which are how much you’re responsible for out-of-pocket in the event of a covered Claim, and limits which are the most your insurer will pay for a covered claim. Home insurance is coverage you hope to never have to use, but if the unexpected happens, it can help you restore your life back to normal.Learn more about homeowners insurance.

Featured Articles

![Man with hands on steering wheel.]()

Telematics: 5 Reasons to Try "Pay How You Drive" Car Insurance

Telematics: 5 Reasons to Try "Pay How You Drive" Car InsuranceWith the ongoing development of technology in cars to help us drive safely, there is an opportunity to help raise awareness of your driving behaviors.![Man setting up smart technology at home]()

How Smart Home Technology Helps Protect Your Home [Video]

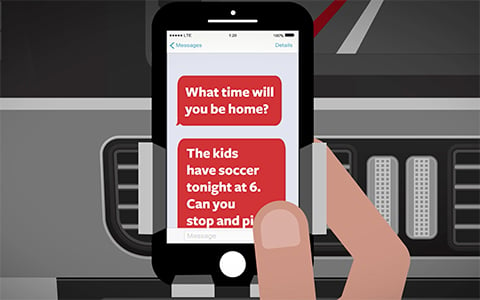

How Smart Home Technology Helps Protect Your Home [Video]Smart home technology offers ease and convenience. It can also help protect your home and reduce home insurance costs.![Animated image of a hand holding a phone, meant to interpret someone reading text messages and being distracted from the road]()

Stop Distracted Driving: Texting [Video]

Stop Distracted Driving: Texting [Video]Every second you take your eyes off the road to do another task, like text, read, reach over, groom or eat, can be dangerous. Share these videos to help raise awareness.![Home renovation covered by replacement cost homeowners insurance.]()

Is Your Home Insurance to Its Replacement Cost?

Is Your Home Insurance to Its Replacement Cost?If your home isn't insurance to its estimated replacement cost, your homeowners policy may not cover the full cost to rebuild.![Video about umbrella insurance]()

Understanding an Umbrella Policy [Video]

Understanding an Umbrella Policy [Video]Umbrella insurance provides extra liability coverage that can help protect assets. It also helps cover defense costs, attorney fees and other charges associated with lawsuits.![Cars driving on a rainy and foggy highway]()

How to Drive Safety in Strong Wind and Rain [Video]

How to Drive Safety in Strong Wind and Rain [Video]When driving in heavy rain or wind, be aware of your surroundings and take steps to help you arrive safely at your destination.

=cathy@skeenins.com

Clifford Ray Moore Jr Inc

Personal Insurance

Clifford Ray Moore Jr Inc